Finance

How Could a Savings Account Be Created for You and Your Child?

A savings account is among the safest locations to keep your money for short-term objectives, whether you’re accumulating an emergency fund or saving for a significant purchase.

Government insurance is often available for your money. Even better, you’ll earn a little bit of interest on the money in your account.

You can often open the score in under an hour after searching for the greatest savings score. Learn the procedures to make the process go more quickly for you.

[lwptoc]

How To Choose The Ideal Savings Account

It might be advantageous to have a savings account, but it may not be simple to decide which account to choose. Numerous organizations provide a wide range of banking services.

The following should be taken into account when you weigh your options:

- Plan your usage of it.

- Determine the characteristics that are essential to you.

- Choose the bank that you wish to use.

- Think about interest rates.

- For costs, review the small print.

A Savings Account Grows in What Ways?

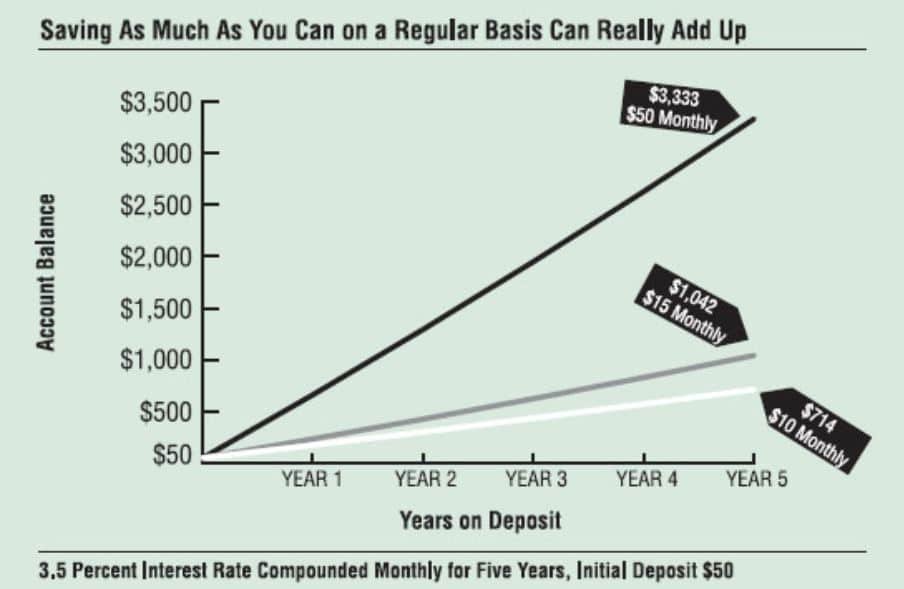

With automated transfers from your checking account to your savings account, you may set a goal and achieve it. Plus, depending on the amount in your savings account, a savings score often pays interest.

To calculate the value of your funds, utilize a savings account calculator. You may calculate the growth of your money fast by using a calculator for savings accounts.

How To Start a Savings Account in Stages?

If you used to borrow money from friends and acquaintances or quick small personal loans but now you understand that it is better to save money in a savings account, then these steps are for you:

Determine How to Apply

Depending on the institution, you may apply by mail, phone, in-person, or even online. Online applications may take between 10 and 20 minutes to complete.

Compile All of Your Identification

Your Social Security number (or tax ID number) and details from a government-issued ID, such as a driver’s license or passport number, would probably be required for the application.

Give Your Contact Information

Expect to submit your first and last name, phone number, and address in addition to your ID number; normally, you must be based in the United States.

Additionally, information like your email address and birthdate could be requested of you.

Decide Between a Sole and Joint Account

If you want to establish the account alone or with a partner, let the institution know. For everyone else whose name will appear on the account, you’ll need the details from the earlier stages.

Agree to the Rules and Regulations

The bank will now ask you to certify that you have read the disclosure materials outlining the costs, obligations, and how account interest is computed.

You should ideally have chosen an account with high rates of return and little to no monthly servicing fees. This is your opportunity to confirm.

Fill Out the Application

When you apply online, you could receive an acknowledgment in a matter of minutes, but it can take the bank two to five business days to check your information, establish the account, and provide you access.

Add Money to Your New Account

Some banks have no minimum deposit requirements, while others often need an initial investment of between $30 and $100.

Link: https://www.fdic.gov/about/learn/learning/accounts.html

Even if you don’t need to fund your account right away, it’s still a good idea to do so as soon as possible. You’ll be able to start receiving attention sooner if you do it that way.

You may deposit a cheque or transfer money from an existing account at another bank. The possibility of scheduling a wire transfer from another institution exists.

After you’ve deposited money into your account, think about setting up a direct deposit and arranging automatic transfers from your checking account to your savings score.

These steps will help your balance increase over time without much of your conscious effort.

Choosing a Bank for an Account in Savings

It is essential to compare Savings Accounts from many banks before opening a new account.

Based on their reputation, customer service, interest rate, required minimum amount, and kinds of accounts the bank offers, you may compare them.

To learn more about a bank’s savings score, go to its official website. To make the best choice, look at the websites of at least a few reputable US banks.

But you have another profitable option for saving money. It is in your interest to save as much as possible and get the maximum benefit. Therefore, many Americans open a Health Savings Account (HSA) to protect their funds from taxation.

How to Create a Child’s Savings Account

State regulations and business practices differ, but generally speaking, opening an account without an adult is exceedingly difficult for a youngster under the age of 18.

Most banks mandate that customers under the age of 18 have joint accounts with adults.

Your kid will need to provide their birth certificate or Social Security card, and you will need to present your personal information and proof of identity.

What Benefit Does Having a Savings Account Offer?

With so many factors to take into consideration, it’s important to understand the benefits of establishing a savings score before making your decision.

If you’re thinking about creating a savings account or you already have one, have the following benefits in mind:

- A method to save money is via savings accounts.

- If a savings account is created in a bank covered by the FDIC’s insurance, it is guaranteed in the United States.

You may save with the aid of a savings account and maintain your focus on your long-term objectives. Find a savings account that suits your requirements and your preferences if you’re wanting to start one.

Bottom Line

People who wish to lay money away for a goal or an emergency fund might benefit greatly from using savings accounts.

Look at all of your possibilities, including regional and internet financial institutions, and choose the account that gives the highest interest rates at the most affordable price.

You may get the most out of your money by taking the time to compare shops.

Read about: Saving and Investing: Personal Finance

-

Celebrity4 weeks ago

Celebrity4 weeks agoIs YNW Melly Out Of Jail? What Is The YNW Melly Release Date, Career, Early Life, And More

-

Sports4 weeks ago

Sports4 weeks agoMore Than Just a Game: How College Sports Can Shape Your Future

-

Tech3 weeks ago

Tech3 weeks agoAI Software: Transforming the Future of Technology

-

Tech3 weeks ago

Tech3 weeks agoAll About Com. Dti. Folder Launcher: Features, Benefits, Tips, And More