Finance

Free Forex Buy And Sell Indicators Really Help Forex Traders

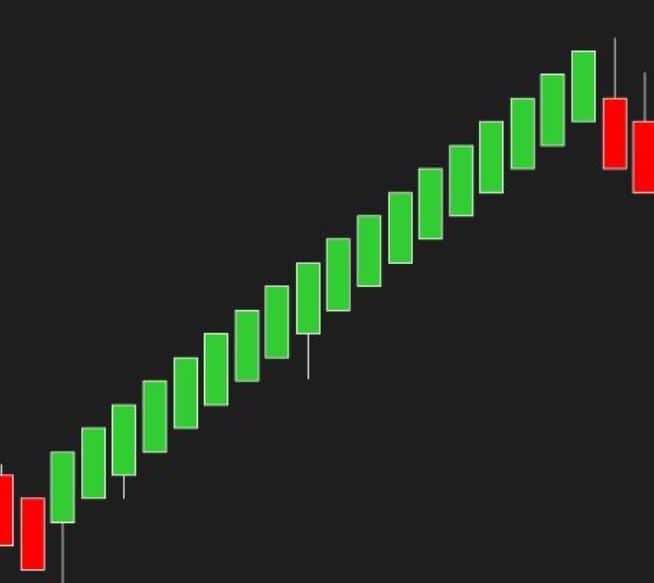

An important concept in the day-to-day work of a trader is support and resistance (S&R), which helps reduce risks and find more accurate points of entry to the market. The concepts of support and resistance are undoubtedly two of the most highly discussed attributes of technical analysis.

Support occurs where a downtrend is expected to pause, because of a concentration of demand. Resistance occurs where an uptrend is expected to pause temporarily, because of a concentration of supply. Market psychology plays a major role as traders and investors remember the past and react to changing conditions to anticipate future market movement.

Professional traders who rely on technical analysis use indicators. Professional traders who do not rely on technical patterns tend to keep the use of indicators to a minimum, if at all. Trading indicators analyze the statistical trends of price movements and trading volume to predict market trends.

As part of analyzing chart patterns, traders use these terms to refer to price levels on charts that act as barriers, preventing the price of an asset from getting pushed in a certain direction. At first, the explanation and idea behind identifying these levels seem easy, but as you’ll find out, support and resistance can come in various forms, and the concept is more difficult to master than it first appears.

[lwptoc]

How do the indicators work?

The MT4 forex resistance and support indicator provide traders with a powerful tool to manage their trades and risk. The software actively monitors price movements and highlights the most important price levels in order to avoid losses or take profits. The indicator is available in the Strategy Tester, on the chart, as well as an additional line on the chart.

The indicator automatically finds the levels or zones where several recently formed fractals are located. Used as horizontal support/resistance lines, they show the areas where price movement is most likely to reverse. Unlike conventional support and resistance lines, fractals are very dynamic, which makes them much more valuable in determining entry and exit points. The support and resistance indicator is one of the key elements to trading success and not just a tool to be used occasionally.

The indicator shows the found levels by color: Blue color shows support levels and Orange color shows resistance levels.

There are three basic strategies for trading based on the support and resistance levels:

The more times Support or Resistance (SR) is tested, the weaker it becomes:

As you’ve probably read in trading books, Support and Resistance become stronger the more times they’re tested. This is not true. When Support or Resistance is tested more times, it becomes weaker.

Here; why

Because there is buying pressure to push the price higher, the market reverses at Support. Buying pressure could come from institutions, banks, or smart money that trades large orders.

The market will eventually fill these orders if it keeps testing Support. Then who will buy it?

Usually, higher lows into resistance result in a breakout (ascending triangle). Lower highs into support result in a breakdown (descending triangle).

Also, check out FxPro review about the reliable broker company.

Support and Resistance can be dynamic:

What you’ve learned earlier is horizontal SR (where the areas are fixed).

But it can also change over time, otherwise known as, Dynamic Support and Resistance. There are two ways to identify Dynamic SR.

You can use: Moving average, Trend line

Using the moving average to identify dynamic SR. Dynamic SR can also be identified by using the 20 & 50 MA. However, this is not the only way. We can use 100 or 200 MA, and it works fine. In the end, find something that suits you (and not blindly follow another trader). There are diagonal lines on your chart to identify dynamic SR.

Which of the strategies should be used?

The strategies listed above can neither be right nor wrong, so there is no definitive answer to this question. All of them will provide profitable or false signals. You can try each on a demo account to see which works best for you.

Reduce losses and evaluate profit growth potential.

Read more: Forex Brokers Helps You Find the Best Way to Trade

-

Celebrity4 weeks ago

Celebrity4 weeks agoIs YNW Melly Out Of Jail? What Is The YNW Melly Release Date, Career, Early Life, And More

-

Sports4 weeks ago

Sports4 weeks agoMore Than Just a Game: How College Sports Can Shape Your Future

-

Tech3 weeks ago

Tech3 weeks agoAI Software: Transforming the Future of Technology

-

Tech3 weeks ago

Tech3 weeks agoAll About Com. Dti. Folder Launcher: Features, Benefits, Tips, And More