Finance

GO Markets Review

What is forex trading?

Every day, a large number of exchanges are made in a cash trade market called Forex. “Forex” straightforwardly stems from the start of two words – “unfamiliar” and “trade”. Not at all like other exchanging frameworks, for example, the securities exchange, Forex doesn’t include the exchanging of any products, physical or agent. All things being equal, Forex works through purchasing, selling, and exchanging between the monetary standards of different economies from around the world. Since the Forex market is genuinely a worldwide exchange framework, exchanges are made 24 hours every day, five days per week. Likewise

Forex isn’t limited by any one control office, and that implies that Forex is the main genuine unregulated economy financial exchange framework accessible today. By avoiding the trade rates with regards to any one gathering’s hands, it is substantially more challenging to try and endeavor to control or corner the money market. With every one of the benefits related to the Forex framework, and the worldwide scope of support, the Forex market is the biggest market in the whole world. Anyplace between 1 trillion and 1.5 trillion identical US dollars are exchanged on the Forex market every single day.

Forex currencies :

The Euro and the US dollar are likely the two most notable monetary standards that are utilized in the Forex market, and subsequently, they are two of the most broadly exchanged in the Forex market. Notwithstanding the two “rulers of cash”, there are a couple of different monetary standards that have gained notoriety for Forex exchanging. The Australian Dollar, the Japanese Yen, the Canadian Dollar, and the New Zealand Dollar are stapled monetary standards utilized by laid-out Forex dealers. Notwithstanding, it means quite a bit to take note of that on most Forex administrations, you won’t see the complete name of money worked out. Every cash has its image, similarly as organizations engaged with the securities exchange have their image dependent on the name of their organization. A portion of the significant currencies to know are:

USD – US Dollar

EUR – The Euro

Computer-aided design – The Canadian Dollar

AUD – The Australian Dollar

JPY – The Japanese Yen

NZD – The New Zealand Dollar

Albeit the images might be confounding from the start, you’ll become acclimated to them sooner or later. Recollect that every cash’s image is sensibly framed from the name of the money, typically in some type of abbreviation. With just the right amount of training, you’ll have the option to decide on most money codes without finding them.

Read more: Things to Consider when Choosing a Forex Trading Strategy?

Forex market :

Probably the most extravagant individuals on the planet have Forex as a huge piece of their speculation portfolio. Warren Smorgasbord, the world’s most extravagant man, has more than $20 Billion put resources into different monetary forms on the Forex market. His income portfolio ordinarily remembers above and beyond 100,000,000 bucks for benefit from Forex exchanges every quartile. George Soros is one more large name in the field of money exchange – it is accepted that he made more than $1 billion in benefits from a solitary day of exchanging 1992! Albeit such exchanges are exceptionally intriguing, he was as yet ready to accumulate more than $7 Billion from thirty years of exchanging on the Forex market. The methodology of George Soros additionally demonstrates that you don’t need to be excessively dangerous to create gains on Forex – his moderate technique includes pulling out huge bits of his benefits from the market, in any event, when the pattern of his different ventures appears to in any case connect vertically.

Fortunately, you don’t need to contribute a large number of dollars to create a gain on Forex. Many individuals have recorded their prosperity by beginning ventures of somewhere in the range of $10,000 to just $100 for an underlying speculation. This large number of monetary prerequisites makes Forex an appealing scene for exchanging among all classes.

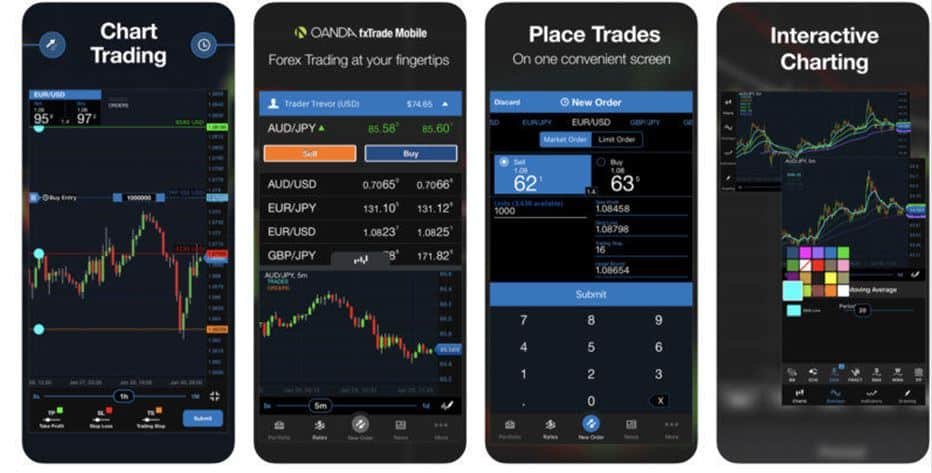

Best forex app

If you have any desire to trade monetary standards, you’ll have to find a reasonable merchant that offers local forex exchanging applications. In doing as such, you’ll have the option to get to the forex markets all day, every day – regardless of where you are found.

This implies that you can enter trade positions at the snap of a button. Contingent upon your picked supplier, you could likewise approach specialized and basic examination devices, store and withdrawal offices, and the capacity to set constant cost alarms.

In this aid, we investigate the best forex app of 2022. Our audit interaction takes a gander at different measurements – like a guideline, exchanging commissions, upheld matches, installments, and client care.

According to our discoveries, underneath you will find the best 9 forex exchanging applications for iPhone and Android. You’ll find a definite outline of each application further down on this page.

- eToro: Best all-over forex exchanging application. Without commission exchanging and many cash matches.

- Plus500: Advantage from 0% commission exchanging at a vigorously directed intermediary.

- Forex.com: Best forex exchanging application for US occupants.

- IG: Believed UK financier firm sent off in 1974. 0% commissions while exchanging forex.

- FXCM: Valuable forex exchanging that is viable with MetaTrader 4.

- FXTM: Forex exchanging application that permits you to store from just £/$ 10. Extraordinary for beginners.

- Trading212: Super-clean forex exchanging application for UK occupants. No commissions and tight spreads.

- AvaTrade: Laid out forex exchanging application with help for MetaTrader 4. Incredible for prepared dealers.

- 24Option: Best forex exchanging application for Europeans. Influence offices for all merchants.

GO Markets

GO Markets sectors were established in 2006 in Melbourne, Australia, and is a monetary administration supplier of online Unfamiliar Trade (Forex) exchanging administrations, offering Edge FX and CFD Exchanging to people and institutional clients. Generally viewed as the merchant that effectively presented Meta Dealer 4 (“MT4”) to Australian retail brokers, we have a certified group of experts with top to bottom information and priceless involvement in the web-based exchange stage.

GO Markets review :

Here is a quick GO Markets review:

GO Markets sectors has won 3 honors in the current year’s Worldwide Forex Grants; Best ForexFintech Merchant – Worldwide, Best Forex Exchanging Backing – Asia, and Generally Confided in Specialist – Europe. The Worldwide Forex Grants perceives forex and related organizations from around the world,

Are GO Markets sectors directed?

GO Markets sectors are directed by the Australian Protections and Speculations Commission (ASIC), the Cyprus Protections and Trade Commission (CySEC), and the Monetary Administrations Commission of Mauritius (FSC). ASIC is a top-level controller yet CySEC and the FSC are not in the top-level class.

Main concern :

GO markets sectors is an Australian forex and CFD agent.

The representative offers low forex expenses and charges no latency, store, or withdrawal expenses. The record opening is quick and completely computerized and there are a few, great instructive devices.

Check out: A Comprehensive Guide to Online Forex Trading Accounts

-

Entertainment1 month ago

Entertainment1 month ago123Movies Alternatives: 13 Best Streaming Sites in 2026

-

Entertainment2 months ago

Entertainment2 months ago13 Free FMovies Alternatives to Watch Movies Online in 2026

-

Entertainment1 month ago

Entertainment1 month ago13 Flixtor Alternatives to Stream Free Movies [2026]

-

Entertainment1 month ago

Entertainment1 month agoGoMovies is Down? Here are the 11 Best Alternatives