Finance

How to Invest Mutual Funds for Beginners Step by Step

Investing in mutual funds is one of the most common ways beginners start building long-term wealth. Mutual funds allow individuals to invest in a diversified portfolio without needing advanced market knowledge. This article explains the process step by step, in clear language, so new investors can begin with confidence and avoid common mistakes.

What mutual funds are and how they work

Mutual funds collect money from many investors and invest it in stocks, bonds, or other assets in accordance with a defined strategy. Each investor owns units of the fund, and the value of those units changes according to the performance of the underlying investments. Professional fund managers make decisions about buying and selling assets, which removes the need for investors to manage individual securities themselves.

Mutual funds are suitable for beginners because they offer diversification, professional management, and flexibility in investment amounts. They are regulated financial products, which adds a layer of protection for investors.

Step 1: Understand your financial goals

Before investing, beginners should clearly define why they want to invest. Goals may include saving for retirement, building an emergency fund, planning for education, or growing wealth over time. The goal determines the type of mutual fund that may be appropriate.

Short-term goals usually require lower risk, while long-term goals can tolerate more volatility. Knowing your time horizon helps prevent emotional decisions during market fluctuations.

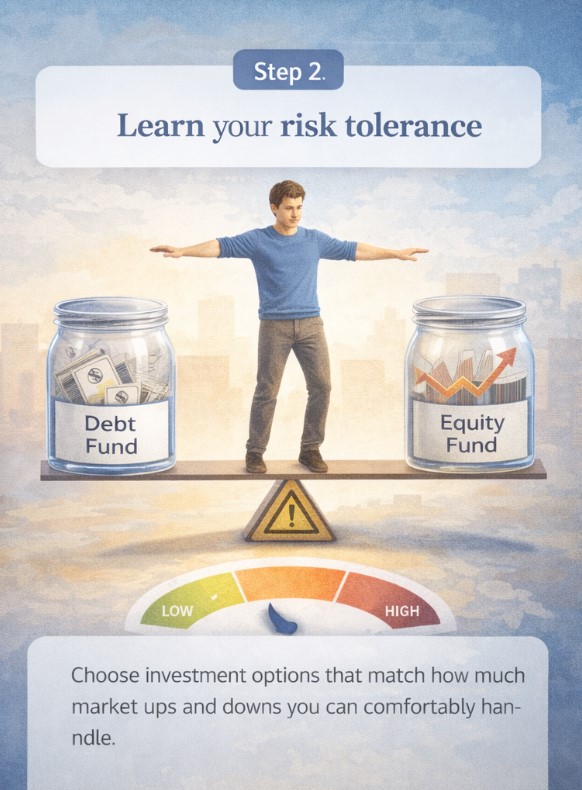

Step 2: Learn your risk tolerance

Risk tolerance refers to how much fluctuation in value you can accept without panic. Some investors are comfortable with ups and downs, while others prefer stability. Mutual funds range from low-risk debt funds to higher-risk equity funds.

Factors that affect risk tolerance include age, income stability, financial responsibilities, and personal comfort with market changes. Beginners should choose funds that align with their ability to stay invested during market declines.

Step 3: Know the types of mutual funds

Understanding fund categories is essential before investing. Common types include:

- Equity funds that invest mainly in stocks

- Debt funds that focus on bonds and fixed-income securities

- Hybrid funds that combine stocks and bonds

- Index funds that track market indexes

- Money market funds for short-term, low-risk investing

Each type serves different investment objectives and risk profiles.

Step 4: Choose an investment approach

Beginners can invest in mutual funds in two main ways. One option is a lump sum investment, where a fixed amount is invested at once. The other option is a systematic investment plan, where smaller amounts are invested regularly.

Systematic investing reduces the impact of market timing and helps develop discipline. It is often recommended for beginners because it spreads investment over time and lowers emotional stress.

Step 5: Select a fund based on research

Choosing a fund requires basic research rather than guessing or following trends. Key factors to review include past performance over long periods, expense ratio, fund manager experience, and consistency with the fund’s stated objective.

Beginners should avoid selecting funds solely based on short-term returns. A stable track record and alignment with personal goals matter more than recent performance spikes.

Step 6: Complete account setup

To invest, an account must be opened with a mutual fund provider or an investment platform. This process usually involves identity verification, bank linking, and completing required documentation.

Once the account is active, investors can browse available funds, compare options, and make their first investment. Most platforms provide tools that simplify the process for beginners.

Step 7: Make your first investment

After selecting a fund and investment amount, the transaction can be completed online. Units are allocated based on the fund’s current net asset value. Confirmation is usually sent once the investment is processed.

Beginners often start with a small amount to gain experience. Over time, contributions can be increased as confidence grows.

This step is often when people search for how to invest in mutual funds because they want reassurance that the process is straightforward and accessible.

Step 8: Monitor investments periodically

Monitoring does not mean checking daily prices. Instead, investors should review performance periodically to ensure the fund remains aligned with goals. Changes in life circumstances or financial priorities may require adjustments.

Rebalancing may be necessary if asset allocation shifts significantly due to market movement. This helps maintain the desired risk level.

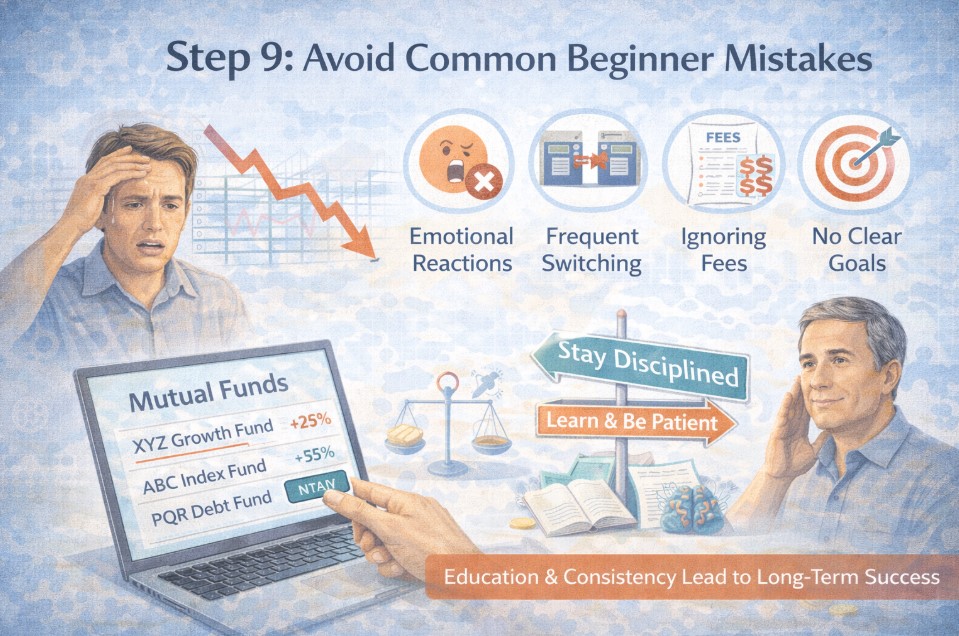

Step 9: Avoid common beginner mistakes

New investors often make avoidable mistakes that reduce long-term returns. These include reacting emotionally to market movements, frequently switching funds, ignoring fees, and investing without clear goals.

Staying patient and disciplined is more effective than chasing short-term gains. Education and consistency play a major role in long-term success.

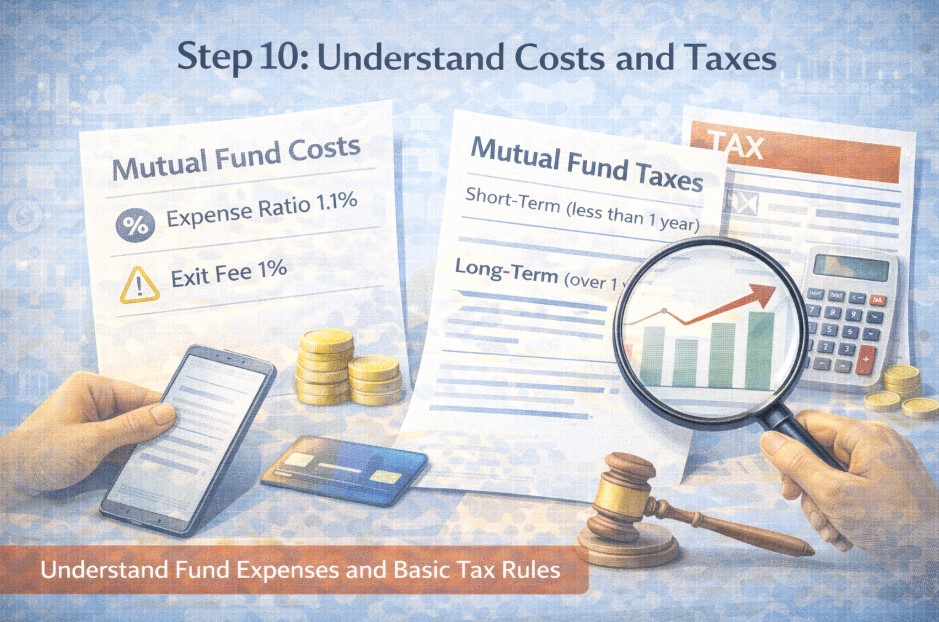

Step 10: Understand costs and taxes

Mutual funds involve costs such as expense ratios and, in some cases, exit fees. These costs reduce returns over time, so choosing funds with reasonable expenses is important.

Tax treatment varies based on fund type and holding period. Beginners should understand basic tax rules or consult a professional to avoid surprises.

Why mutual funds suit beginners

Mutual funds simplify investing by removing the need for stock selection and market timing. They allow beginners to start with small amounts and benefit from diversification.

For those searching for how to invest mutual funds for beginners, the key advantage is accessibility combined with professional management. This combination makes mutual funds an effective entry point into investing.

Using a structured approach

Following a clear process helps beginners stay focused and avoid confusion. A mutual funds investment guide provides structure by outlining each step logically, from goal setting to ongoing monitoring.

A structured approach encourages informed decisions rather than impulsive actions. It also builds confidence over time.

Long-term perspective matters

Investing is not about quick results. Mutual funds are designed for long-term growth, and patience is essential. Market fluctuations are normal, and staying invested through different cycles often leads to better outcomes.

Beginners who focus on long-term goals rather than short-term noise are more likely to achieve financial stability.

Final thoughts

Starting to invest in mutual funds does not require advanced knowledge or large capital. By understanding goals, risk tolerance, fund types, and basic processes, beginners can build a solid foundation.

This step-by-step approach helps reduce uncertainty and encourages disciplined investing. With time, education, and consistency, mutual fund investing can become a reliable tool for financial growth.

-

Entertainment1 month ago

Entertainment1 month ago123Movies Alternatives: 13 Best Streaming Sites in 2026

-

Entertainment2 months ago

Entertainment2 months ago13 Free FMovies Alternatives to Watch Movies Online in 2026

-

Entertainment1 month ago

Entertainment1 month ago13 Flixtor Alternatives to Stream Free Movies [2026]

-

Entertainment1 month ago

Entertainment1 month agoGoMovies is Down? Here are the 11 Best Alternatives