Finance

HSBC Business Account: How to Create and Log In

Businesses need reliable banking services to handle payments, payroll, and other transactions. HSBC is one of the largest banks in the world and offers banking products designed for businesses of all sizes. From small enterprises to large corporations, the HSBC business account provides tools and features to manage financial needs effectively. This guide will explain how to create a business account with HSBC, the steps involved in the login process, and what you can expect after setting up your account.

Why Choose HSBC for Business Banking

Before opening an account, it helps to understand why HSBC is popular among businesses. The bank has operations in many countries, which makes it easier for companies with international clients or suppliers. Features such as multi-currency accounts, online platforms, and integration with accounting software are designed to help business owners save time and reduce costs.

Key reasons businesses prefer HSBC include:

- Global presence with branches and services across multiple countries

- Different account types suited for startups, SMEs, and larger enterprises

- Digital banking solutions with secure access via desktop or mobile apps

- Access to loans, credit cards, and merchant services for business growth

- Support from dedicated relationship managers in certain account tiers

With these advantages, many entrepreneurs and established companies view HSBC as a strong banking partner.

Preparing to Open an Account

To create an account, you need to prepare certain documents and details. HSBC has strict compliance rules due to international banking regulations, so being organized will save time.

Common requirements include:

- Proof of identity, such as a passport or driver’s license, for all directors and authorized signatories

- Proof of address, such as utility bills or bank statements

- Business registration documents, such as a certificate of incorporation for companies or partnership agreements for partnerships

- Tax identification details, depending on your jurisdiction

- Business plan or summary for new companies, especially if applying for credit facilities

Each country may have slightly different requirements, so it is best to check with the HSBC branch in your region before applying.

Choosing the Right Type of Business Account

HSBC provides different account categories based on business size and need. Some examples include:

- Startup accounts for new businesses that need basic banking functions

- SME accounts for small and medium-sized businesses requiring advanced tools

- International accounts for companies dealing with foreign currencies and overseas clients

- Corporate accounts for larger organizations needing multiple features and customized solutions

When deciding, consider the nature of your business, the expected transaction volume, and whether you require additional services such as trade finance or merchant payment processing.

Steps to Create an HSBC Business Account

Opening a business account involves a clear process. Depending on your location, you may be able to complete part of the process online, but often you will need to meet with a bank representative.

- Research account types on the HSBC website or by contacting a local branch.

- Collect all necessary documents, including identification and company paperwork.

- Submit an online application if available, or book an appointment at a branch.

- Attend the appointment with all directors or partners required by the bank.

- Provide detailed information about your business, including expected transaction levels and international needs.

- Wait for the verification process, where HSBC checks your documents and may request further information.

- Once approved, your account will be activated, and you will receive login details for online banking.

The verification stage may take longer for international companies or businesses in regulated industries.

HSBC Online Banking Setup

After your account is opened, setting up online access is the next step. HSBC offers digital banking services that allow you to manage payments, transfers, and account monitoring from your computer or smartphone.

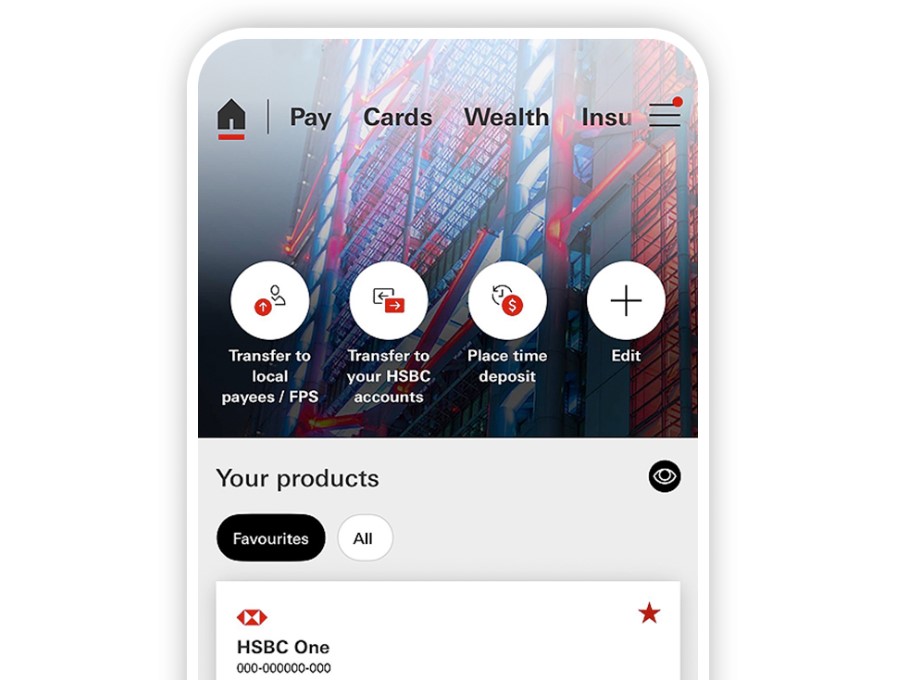

Image Source: hsbc.com.hk

To get started:

- Visit the HSBC online banking website for your country.

- Register for online services using your account number and security information.

- Set up a secure username and password, following the guidelines provided.

- Enable two-factor authentication where available for added security.

- Download the HSBC business mobile app for convenient access on the go.

Once set up, you will be able to check balances, transfer funds, approve payments, and manage multiple accounts.

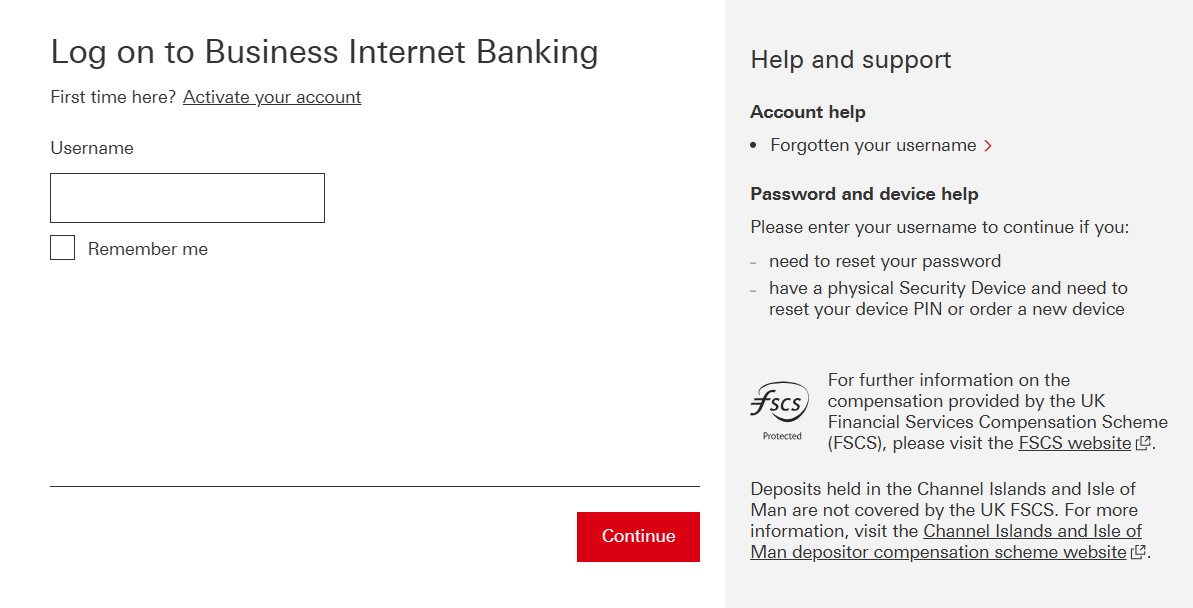

How to Log In to Your HSBC Business Account

Logging in is straightforward once your digital banking profile is created.

- Go to the HSBC business online banking page.

- Enter your username.

- Provide your password or use a security device if issued by the bank.

- Complete any two-factor authentication steps required.

- Access your dashboard to view balances and transactions.

It is recommended that you always log in from official HSBC websites or apps to avoid phishing attempts.

Security Measures and Tips

HSBC places strong emphasis on account security. They use encryption and two-factor authentication to protect customer information. As a user, you should also follow best practices to secure your account:

- Never share your password or security codes with anyone.

- Regularly update your login details.

- Avoid accessing your account from public Wi-Fi networks.

- Set up account alerts to receive notifications of unusual activity.

These steps will help protect your business against fraud and unauthorized access.

Features of an HSBC Business Account

Beyond basic transactions, HSBC provides tools designed for businesses. Some of the most common features include:

- Online and mobile banking with real-time updates

- International transfer services in multiple currencies

- Payroll support and integration with popular accounting software

- Access to business loans and lines of credit

- Merchant payment processing solutions

- Expense management tools for tracking spending

These features are especially useful for small businesses trying to scale operations and for larger firms managing complex finances.

Costs and Fees

Business accounts usually have fees, and HSBC is no exception. Charges may include monthly maintenance fees, transaction charges, and international transfer fees. However, some accounts offer fee waivers for startups or companies that maintain a minimum balance.

It is important to review the fee structure before opening your account. Understanding the costs will help you avoid surprises and plan for them in your financial management.

Customer Support and Assistance

HSBC provides support channels to assist business customers. Options may include:

- Dedicated relationship managers for certain account tiers

- 24/7 customer service hotlines

- Online help centers with FAQs and guides

- In-person assistance at branches

This support ensures that businesses can resolve issues quickly and continue focusing on operations.

Troubleshooting Login Problems

Even with a well-designed platform, users may face occasional issues while logging into their HSBC business account. Knowing common problems and solutions can save time and reduce stress.

- Forgotten Username or Password:

If you forget your login details, you can use the “Forgot Username” or “Forgot Password” link on the login page. You will need to verify your identity using your registered email, phone number, or security device before resetting credentials. - Locked Account:

After several unsuccessful login attempts, the system may lock you out as a security measure. In such cases, contact HSBC customer service or your relationship manager to regain access. - Security Device Issues:

Some HSBC accounts use a physical security token or digital key on the mobile app. If the device malfunctions, you may request a replacement or re-register using the app. - Technical Errors:

Browser compatibility or outdated apps can cause login difficulties. Regularly update your browser and mobile app, clear cache, and ensure a stable internet connection for smooth access.

By being prepared for these challenges, business owners can maintain uninterrupted access to their accounts.

Using the HSBC Mobile App

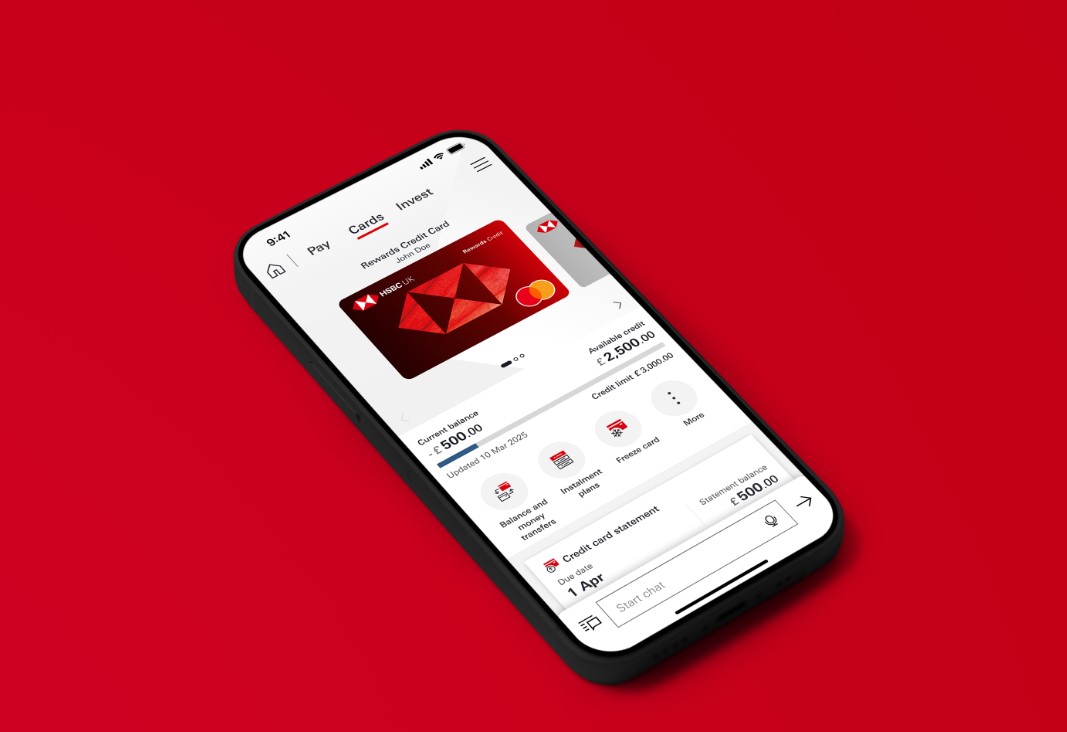

Image Source: FinTech Futures

HSBC provides a mobile app designed for business banking. This app mirrors the functionality of the desktop platform but adds convenience for on-the-go account management.

Main features of the mobile app include:

- Viewing account balances and recent transactions

- Making domestic and international transfers

- Approving payments with built-in security tools

- Managing payroll and supplier payments

- Receiving instant alerts for suspicious activities

The mobile app also integrates with HSBC’s Digital Secure Key, which replaces the need for a separate security device. This makes the login process faster while maintaining strong protection.

International Capabilities

One of HSBC’s biggest advantages is its international presence. Businesses that trade across borders often prefer HSBC because of its ability to manage multiple currencies and simplify international payments.

Features include:

- Multi-currency accounts to hold balances in different denominations

- International wire transfers with competitive exchange rates

- Global reach with branches and partner banks in many countries

- Trade finance solutions for importers and exporters

- Support for businesses expanding into new markets

For companies dealing with suppliers and clients abroad, these services reduce complexity and improve efficiency.

Integration with Business Tools

In 2025, banking is not just about deposits and withdrawals. Companies need accounts that integrate with digital tools to streamline operations. HSBC supports integration with major accounting software such as QuickBooks, Xero, and Sage.

Benefits of this integration include:

- Automatic transaction syncing

- Easier reconciliation of accounts

- Real-time financial reporting

- Simplified payroll processing

By connecting banking data with accounting platforms, businesses can save time and reduce errors in bookkeeping.

Access to Business Financing

An HSBC business account is often the first step toward accessing other financial products. The bank offers loans, lines of credit, and business credit cards linked to your account history.

Examples include:

- Working capital loans for covering day-to-day expenses

- Equipment financing for purchasing machinery or technology

- Commercial mortgages for office or retail spaces

- Business credit cards with tailored rewards and spending controls

Having an existing relationship with the bank can make it easier to apply for these products since the bank already has access to your financial history.

HSBC vs Other Business Banks

When deciding on a business account, many entrepreneurs compare HSBC with other major banks such as Barclays, Citibank, or Wells Fargo. HSBC stands out for its global presence, making it ideal for companies that operate internationally.

However, some smaller local banks may offer lower fees or more personalized services. Businesses should weigh the pros and cons depending on whether they need international capabilities, advanced digital features, or low-cost solutions.

Tips for Maximizing Your HSBC Business Account

Simply opening an account is not enough. To get the most out of HSBC’s services, consider the following strategies:

- Use online banking regularly to monitor transactions and detect irregularities early

- Take advantage of integration features to link your account with accounting tools

- Maintain the minimum balance required to reduce monthly fees

- Explore additional products, such as merchant services, to accept card payments from customers

- Regularly review your account tier to ensure it matches your business growth stage

By actively managing your account, you can unlock more value and avoid unnecessary costs.

Security and Compliance Considerations

HSBC operates under strict international regulations. While this can sometimes mean more paperwork during the account setup process, it also ensures higher standards of compliance. Businesses working in industries such as defense, healthcare, or international trade may benefit from HSBC’s robust compliance framework.

For account holders, it is essential to maintain accurate records and provide updates when company details change. This includes changes in ownership, addresses, or authorized signatories. Staying compliant prevents delays in transactions and protects the account from being flagged during routine reviews.

Case Example: A Small Export Business

To understand how HSBC business accounts work in practice, consider a small export company dealing with clients in Asia and Europe. The business opened a multi-currency account with HSBC to handle payments in dollars, euros, and yen. By using HSBC’s online platform, the company was able to accept international payments quickly and reduce conversion costs.

Additionally, integration with accounting software allowed the business to generate instant financial reports, helping management plan growth strategies. Access to HSBC trade finance also gave the company more flexibility in handling large orders. This example demonstrates how HSBC’s features can be applied in real-world business operations.

Future of HSBC Business Banking

As of 2025, HSBC continues to invest in digital transformation. The bank is improving mobile app performance, adding AI-based financial insights, and expanding its global digital services. These innovations are aimed at helping businesses make faster and more informed decisions.

Future updates may include predictive analytics for cash flow, stronger cyber security measures, and broader integration with third-party business platforms. Staying updated with these advancements will allow companies to use HSBC business accounts more effectively.

Conclusion

Opening and managing an HSBC business account provides access to global financial services, digital tools, and secure banking. The process requires preparation with documents, but once set up, it offers a wide range of features such as international transfers, integration with accounting platforms, and access to financing.

Logging in is simple through the web platform or mobile app, supported by strong security measures. While occasional login problems can occur, solutions are available through customer support and technical troubleshooting.

Businesses can maximize value by regularly reviewing account features, maintaining compliance, and taking advantage of HSBC’s global reach. For companies operating internationally, HSBC remains a strong option due to its presence in multiple markets.

As banking continues to evolve, HSBC is likely to introduce more digital innovations that further improve convenience and security. For business owners, creating an account and learning to log in is just the beginning of a long-term relationship with one of the world’s leading banks.

-

Entertainment1 month ago

Entertainment1 month ago123Movies Alternatives: 13 Best Streaming Sites in 2026

-

Entertainment2 months ago

Entertainment2 months ago13 Free FMovies Alternatives to Watch Movies Online in 2026

-

Entertainment1 month ago

Entertainment1 month ago13 Flixtor Alternatives to Stream Free Movies [2026]

-

Entertainment1 month ago

Entertainment1 month agoGoMovies is Down? Here are the 11 Best Alternatives