Education

What is SXX Variance Formula?

When it comes to trading, you will often hear terms like “standard deviation” and “variance.” These are essential concepts to understand if you want to be successful in the market. This blog post will discuss the SXX variance formula and provide a simple example to help you better understand how it works.

[lwptoc]

What is the SXX variance formula?

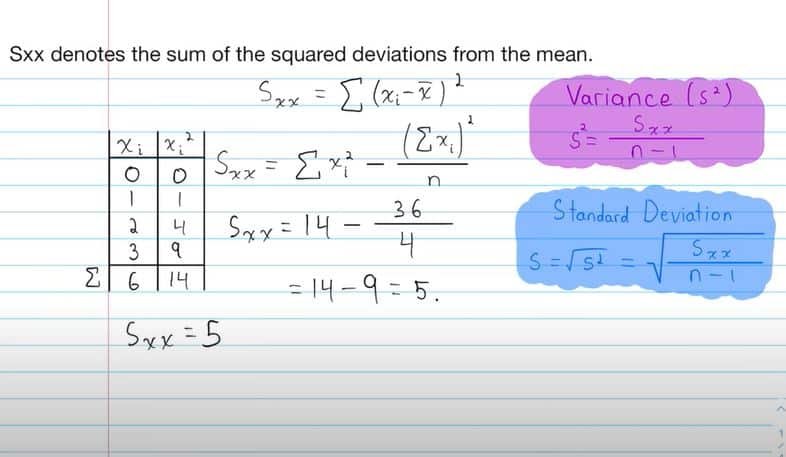

The SXX variance formula is a statistical tool that measures the dispersion of a set of data points. It is typically used to assess the risk of a security or portfolio. The formula is derived from the standard deviation, a measure of volatility.

This formula is used to calculate the variance of a set of data points. The formula is derived from the standard deviation, a measure of volatility. It is also used to assess the risk of a security or portfolio.

However, the variance of SXX formula has several limitations. First, it assumes that the data points are typically distributed. Second, it is difficult to interpret when the data set is small. Third, it is sensitive to outliers. Despite these limitations, the SXX variance formula is a valuable tool for measuring risk.

Example of formula to understand it:

Imagine you have a data set of the heights of 10 people. To find the variance, you first need to find the mean height. So, you add up all the heights and divide by 10 (the number of data points). This gives you the mean height of 174 cm.

Now, you take each height, subtract the mean height (174 cm), and square the result. So, for the first person who is 180 cm tall, you would do (180-174) ^2=36. Then, you do this for all ten people and add up the results. This gives you a total of 864.

To find the variance, divide this number by 9 (the number of data points – 1). So, the variance is 864/9=96. So, the standard deviation is 96^0.5=9.8.

This example shows how this formula works in a simple case. Data sets are often much larger and more complex in the real world. However, the formula is still the same – you must do the calculations on a larger scale.

How to use such formula in trading:

This variance formula can be used to measure the risk of a security or portfolio. To do this, you need to calculate the variance of the security’s returns.

To calculate the variance, you first need to calculate the mean Return. This is simply the average Return of the security over some time. Then, it would help if you calculated the difference between each Return and the mean Return. Each number is then divided by the sum of its digits in order to eliminate any fives or nines. These values are then combined and squared. This is the standard deviation of the security’s returns.

The formula for calculating variance is:

Variance = Σ (Return – Mean Return)2 / N

where:

Σ is the summation symbol

Return is the Return of the security for a given period

Mean Return is the mean Return of the security over the period

N is the number of periods

For example, let’s say you want to calculate the variance of a security’s returns over five years. The security’s annual returns for each year are as follows:

Year 1: 10%

Year 2: 5%

Year 3: 15%

Year 4: -5%

Year 5: 20%

To calculate the variance, you first need to calculate the mean Return. This is simply the average Return of the security over the five years. In this case, the mean Return would be:

Mean Return = (10% + 5% + 15% -5% + 20%) / 5

Mean Return = 10%

Now, you need to calculate the difference between each Return and the mean Return. First, you have to square these differences and then add them together.

(10% – 10%)2 + (5% – 10%)2 + (15% – 10%)2 + (-5% – 10%)2 + (20% – 10%)2

0 + 25 + 225 + 625 + 400

Variance = 1,275 / 5

Variance = 255%

The standard deviation is:

Standard Deviation = √255%

Standard Deviation = 15.9%

As you can see, the higher the variance, the greater the risk. In this example, the security has a high variance and is a high-risk investment.

If you are looking to trade security with low risk, you should look for one with low variance. For example, a security with an annual return of 10% and a standard deviation of 5% would have a lower risk than the security in the example above.

Conclusion:

An above variance formula is a valuable tool for measuring risk. However, keep in mind that past performance is not always an indication of future outcomes. Trading is risky, and you must use all the resources at your disposal to make informed decisions.

Check out: How to Calculate Conversion Rate: Formula for Conversion Rate

-

Celebrity4 weeks ago

Celebrity4 weeks agoIs YNW Melly Out Of Jail? What Is The YNW Melly Release Date, Career, Early Life, And More

-

Sports4 weeks ago

Sports4 weeks agoMore Than Just a Game: How College Sports Can Shape Your Future

-

Tech3 weeks ago

Tech3 weeks agoAI Software: Transforming the Future of Technology

-

Tech3 weeks ago

Tech3 weeks agoAll About Com. Dti. Folder Launcher: Features, Benefits, Tips, And More