Finance

What Is SENS Stock? And Why You Should Invest In It

Every day, I read at least one article about how to invest in stocks.

I have a small portfolio of stock investments, but I still love reading about what other people are buying.

I shake my head at the articles I read most of the time because the investments are so risky.

However, some stocks are worth the risk. One of these is SENS stock.

Here are three reasons you should buy SENS stock today.

- SENS stocks are currently trading at the lowest price they’ve been in five years.

- The company has a strong pipeline of new products.

- The company has high margins.

[lwptoc]

What is SENS Stock?

Founded in 1992, SENS has created a range of environmentally friendly solutions for industrial and agricultural industries.

The company develops, manufactures, and commercializes scientific and environmentally sound technologies that reduce waste, increase productivity, and reduce emissions in various industries, such as oil and gas, power generation, and chemicals.

SENS stock is currently a tiny company, with only $34.4 million in annual revenue. It doesn’t trade on the stock exchange.

However, the company is constantly working on new technologies that it can commercialize in the next few years. For instance, the company announced its Aerogels Aeropress in October 2017. The product will be used for food processing equipment.

Why You Should Invest In It

Most of the companies I read about are focused on biotech.

This industry has a lot of volatility, as the costs of researching new drugs can be very high, which can lead to companies burning through money quickly.

So, what’s exciting about this company?

For one thing, they have a clear product pipeline.

One of the most exciting things about SENS stock is the Orion study, which can transform the treatment of blood cancer.

Orion is a two-pronged treatment approach.

The first part of the treatment involves the anti-cancer drug cetuximab, which was discovered in SENS’s labs.

According to the company, this first part, called cell-based immunotherapy, is currently in Phase III clinical trial in non-Hodgkin’s lymphoma.

SENS stocks are currently trading at the lowest price they’ve been in five years.

The stock price of SENS (formerly known as Radius Health) has taken a nose dive since August of last year. Therefore, this is a great opportunity to buy this company.

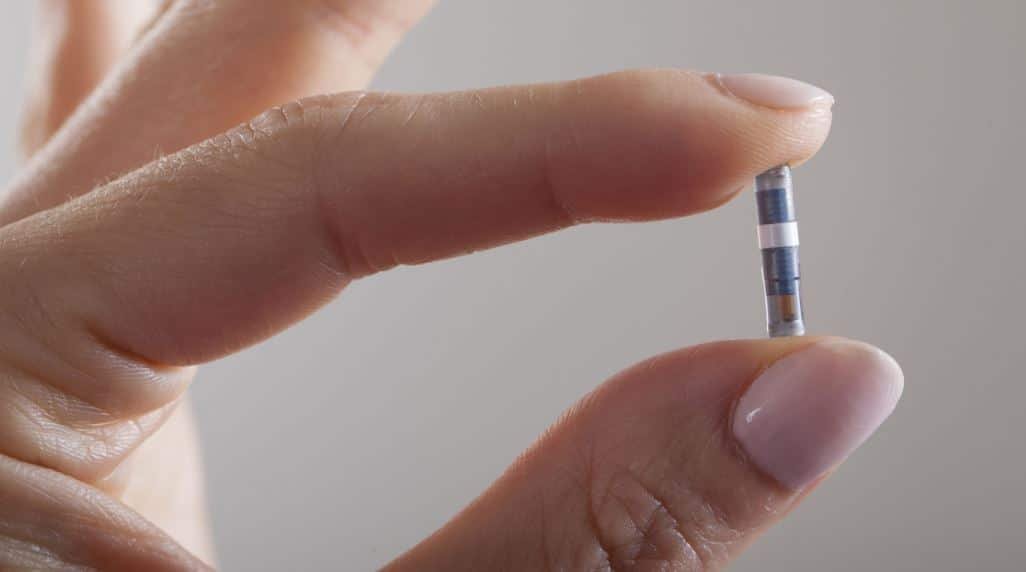

SENS has a great pipeline of new products. Right now, it’s developing two therapies — two splints that can be placed inside the body to repair tissue damaged by auto accidents. The company expects to have these splints on the market by 2022. SENS also has an on-market therapy for dry eye disease.

The stock currently has a market cap of just $1.2 billion. With the stock price down 60% since August, this could be a good entry point for anyone who wants to build a small position in the company.

Unlike many other biotech stocks, SENS does not have any debt.

The company has a strong pipeline of new products.

SENS is a company with cutting-edge technology in the space of regenerative medicine.

The company works with stem cells to understand their behavior so they can develop therapies that could help people with diseases like cancer and arthritis.

Companies like SENS are why I love healthcare investing.

If you’re not familiar with the space, I recommend you read my post from last summer when I highlighted five companies in this space.

Stem cells are still so new that we don’t really understand how they function, but they seem to play a key role in repairing tissues and organs.

Because of this, there’s a huge opportunity in treating chronic diseases, and SENS stock, similarly to SOLO stock, is well-positioned to capitalize on this.

The stock is currently trading at the lowest price it’s been in five years.

The company has high margins.

I already mentioned this, but if you go to Alphabet’s (NASDAQ: GOOG , NASDAQ: GOOGL ) website, you’ll see the phrase “have high margins.”

It’s important for a company to have high margins because it means they can make more money.

For example, I have a friend who owns Starbucks (NASDAQ: SBUX ).

He has about $2,000 invested in SBUX stock.

That means he’s betting that the company can turn around and sell its coffees for $2 each.

SENS has similar margins, and hence from many is considered as one of the best stocks to buy now.

As you can see from the image below, they make about $3 for every $1 spent on drugs.

That’s a very low number, but it’s not unusual for a biotech company.

So what is this company doing?

SENS makes drugs that do things that other drugs don’t do.

Related: EXNESS Reportedly Leading Forex Trading Journey to Endless Fortune

-

Celebrity4 weeks ago

Celebrity4 weeks agoIs YNW Melly Out Of Jail? What Is The YNW Melly Release Date, Career, Early Life, And More

-

Sports4 weeks ago

Sports4 weeks agoMore Than Just a Game: How College Sports Can Shape Your Future

-

Tech3 weeks ago

Tech3 weeks agoAI Software: Transforming the Future of Technology

-

Tech3 weeks ago

Tech3 weeks agoAll About Com. Dti. Folder Launcher: Features, Benefits, Tips, And More