Real Estate

Analyzing the Trends and Implications of Mortgage Delinquency Rates in 2023

Introduction

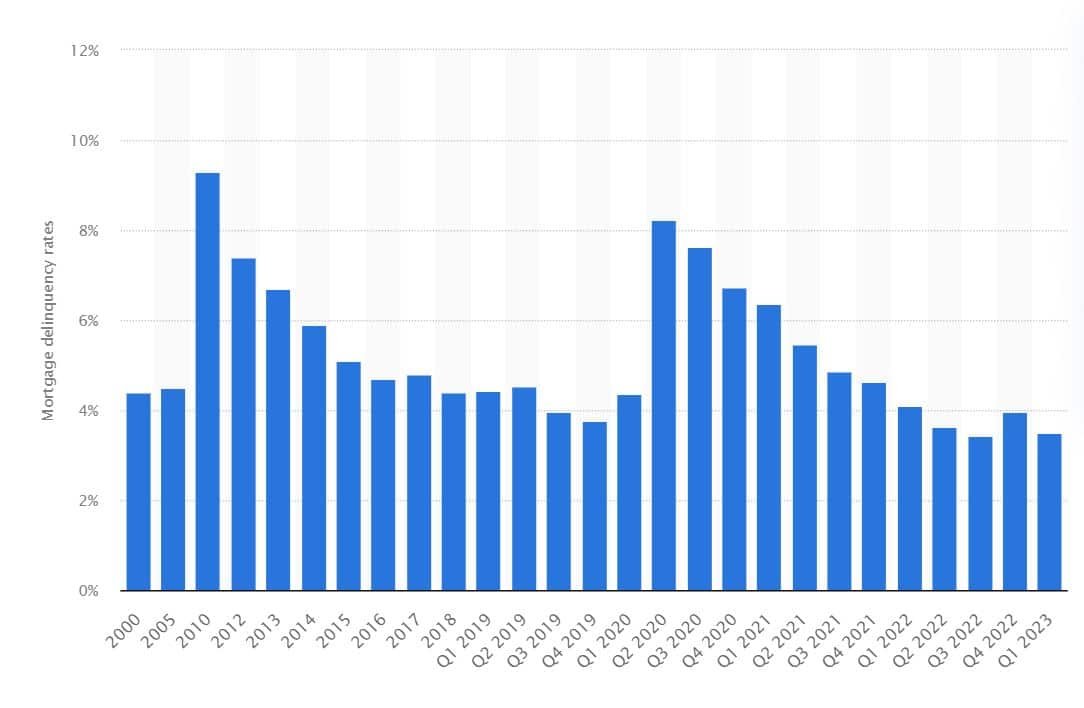

Hey there, financial aficionados! So, you’re wondering what’s up with mortgage delinquency rates this year? We’ve all heard that mortgage delinquencies can be a sign of economic stress or even herald a coming financial crisis—remember 2008? So, where do we stand in 2023? Buckle up, as we dive into the numbers, trends, and what they mean for you and the larger economy.

What Are Mortgage Delinquency Rates?

First off, let’s make sure we’re all on the same page. Mortgage delinquency rates are the percentages of loans that are overdue. Simple as that. But don’t be fooled; the implications can be wide-reaching.

Why Should You Care?

Why does this matter, you ask? Well, high delinquency rates can spell trouble for the housing market and even ripple into the larger economy. It’s like that first domino in a long chain; once it tips, the rest follow.

The 2023 Landscape

Alright, let’s get to the meat of the matter.

Snapshot of the Current Scenario

According to the Mortgage Bankers Association, delinquency rates have seen an uptick in the second quarter of 2023. So, is it time to press the panic button? Not necessarily.

Commercial vs. Residential Rates

Commercial rates are a bit different from residential rates, and in 2023, they’re showing their own patterns. The sectors and types of properties backing the mortgages also come into play, making the picture complex but fascinating.

Factors Affecting Mortgage Delinquency Rates

Interest Rates

One major culprit for the fluctuation? Interest rates. As they go up, so do the delinquencies—generally speaking. Think of interest rates like the temperature of your bathwater. Too hot, and it’s uncomfortable; too cold, and it’s unbearable. Balance is key.

Economic Instability

Inflation, job loss, and market volatility also play roles. They’re the unsavory ingredients in the cocktail that leads to higher delinquency rates.

Property Values

Don’t forget property values. When they’re shaky, so is everything else.

Groups Most Affected

Banks and Thrifts

With delinquency rates standing at 0.66 percent, banks and thrifts saw an increase of 0.09 percentage points from the first quarter. Not a big leap, but still noteworthy.

Life Companies

Their portfolio actually saw a decrease in delinquency rates. Makes you wonder what they’re doing right, huh?

CMBS, Fannie Mae, and Freddie Mac

These groups hold the lion’s share of the mortgage market and have shown varying degrees of increase in delinquencies.

Historical Perspective

Remember the COVID-19 spike? How does 2023 compare to the turmoil of 2020 or the subprime crisis? History doesn’t always repeat itself, but it often rhymes.

From Pandemic to Present

The rate had climbed to a whopping 8.22 percent in 2020 but simmered down to 3.5 percent by early 2023. The decline is good news, but should we get complacent? I wouldn’t bet on it.

What’s Next?

Future Projections

Experts suggest that fluctuations are likely to continue. Don’t get too cozy just yet.

Precautions and Planning

If you’re a homeowner or an investor, now’s the time for due diligence. This is not the period to neglect those mortgage payments.

Conclusion

So, what’s the low-down on mortgage delinquency rates in 2023? Yes, they’ve gone up a bit, but we’re not in freefall. Yet, caution is the name of the game. Stay tuned, stay aware, and most importantly, stay financially savvy.

Happy financing!

-

Celebrity4 weeks ago

Celebrity4 weeks agoIs YNW Melly Out Of Jail? What Is The YNW Melly Release Date, Career, Early Life, And More

-

Sports4 weeks ago

Sports4 weeks agoMore Than Just a Game: How College Sports Can Shape Your Future

-

Tech3 weeks ago

Tech3 weeks agoAI Software: Transforming the Future of Technology

-

Tech3 weeks ago

Tech3 weeks agoAll About Com. Dti. Folder Launcher: Features, Benefits, Tips, And More