Auto

6 Safety Features That Can Save You Money on Car Insurance

Car accidents are a leading cause of death in the United States. With the frequency of car accidents on the rise, it’s more important than ever to take steps to ensure your safety and financial well-being.

The best way to do this is by investing in auto insurance with high coverage limits and low premiums. But there are other ways you can protect yourself from costly damage and injury.

Most car accidents occur because drivers aren’t paying attention, but the right safety feature can take care of that problem. One way to do this is by adding safety features to your car. This can be really helpful if you’re having fleets of commercial vehicles with fleet insurance.

Take a look at these six helpful safety tips for ways you can protect yourself and save money on auto insurance.

[lwptoc]

Airbags

Airbags are one of the most effective ways to protect your driver and passenger. Auto accidents are usually more deadly for front-seat drivers, but airbags can ensure that everyone in the car is safe.

Depending on the severity of the crash, an airbag may deploy in 0.4 seconds after impact with a passenger in close proximity to the bag. This quick response time is why airbags are associated with such a high safety rate.

Collision Warning & Blind-Spot Detection

Collision warning and blind-spot detection are two of drivers’ most important safety features. These features help you avoid accidents by notifying you when there is a car in your blind spot or when you are getting too close to another vehicle.

Both of these features are available on many new cars, and they can often be added to older vehicles through aftermarket systems. Collision warning and blind-spot detection can save you a lot of money on your car insurance by reducing accident rates.

Backup Cameras

Backup cameras provide excellent service by helping drivers avoid accidents before they even happen. These cameras are easy to hook up and only require simple wiring.

They’re also very affordable, making them an attractive option for many people on a budget. If you can’t afford expensive collision coverage, adding a backup camera to your car can be a great way to reduce your premiums.

Anti-Lock Brakes

Anti-lock brakes are a standard safety feature on most new cars. They help drivers maintain control of the vehicle in an emergency situation by preventing the wheels from locking up.

Anti-lock brakes can save you money on your car insurance because they often lead to fewer accidents. If you’re looking for a way to reduce your premiums, consider adding anti-lock brakes to your car.

Adaptive Headlights

Adaptive headlights are a newer safety feature that is becoming more and more popular. These headlights rotate with the steering wheel, allowing drivers to see around corners and in tight spaces.

Adaptive headlights can be a great help during nighttime driving, and they’re also an excellent way to show off your car’s style. Many insurers offer a discount for cars with adaptive headlights, so be sure to ask your agent about this feature.

Anti-Theft Device

An anti-theft device is a great way to protect your car from would-be thieves. These devices make it difficult for criminals to steal your car, and they often come with a discount on your car insurance.

There are many different types of anti-theft devices available on the market, so be sure to do your research and find the best one for you.

Be safe out there! As mentioned in the beginning, auto accidents are a leading cause of death and injury in the United States. By adding some of these safety features to your car, you can reduce your risk of being in an accident and save money on your car insurance.

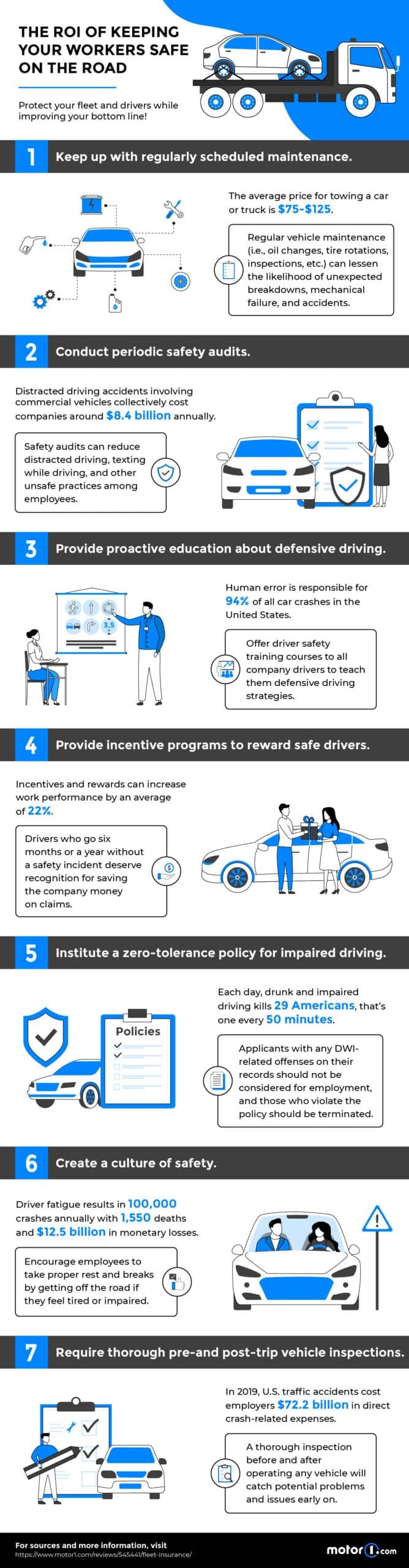

Meanwhile, you can also check the infographic below by Motor1 to know the ROI of keeping your workers safe on the road using the safety features and checks like discussed above.

-

Entertainment1 month ago

Entertainment1 month ago123Movies Alternatives: 13 Best Streaming Sites in 2026

-

Entertainment2 months ago

Entertainment2 months ago13 Free FMovies Alternatives to Watch Movies Online in 2026

-

Entertainment1 month ago

Entertainment1 month ago13 Flixtor Alternatives to Stream Free Movies [2026]

-

Entertainment1 month ago

Entertainment1 month agoGoMovies is Down? Here are the 11 Best Alternatives